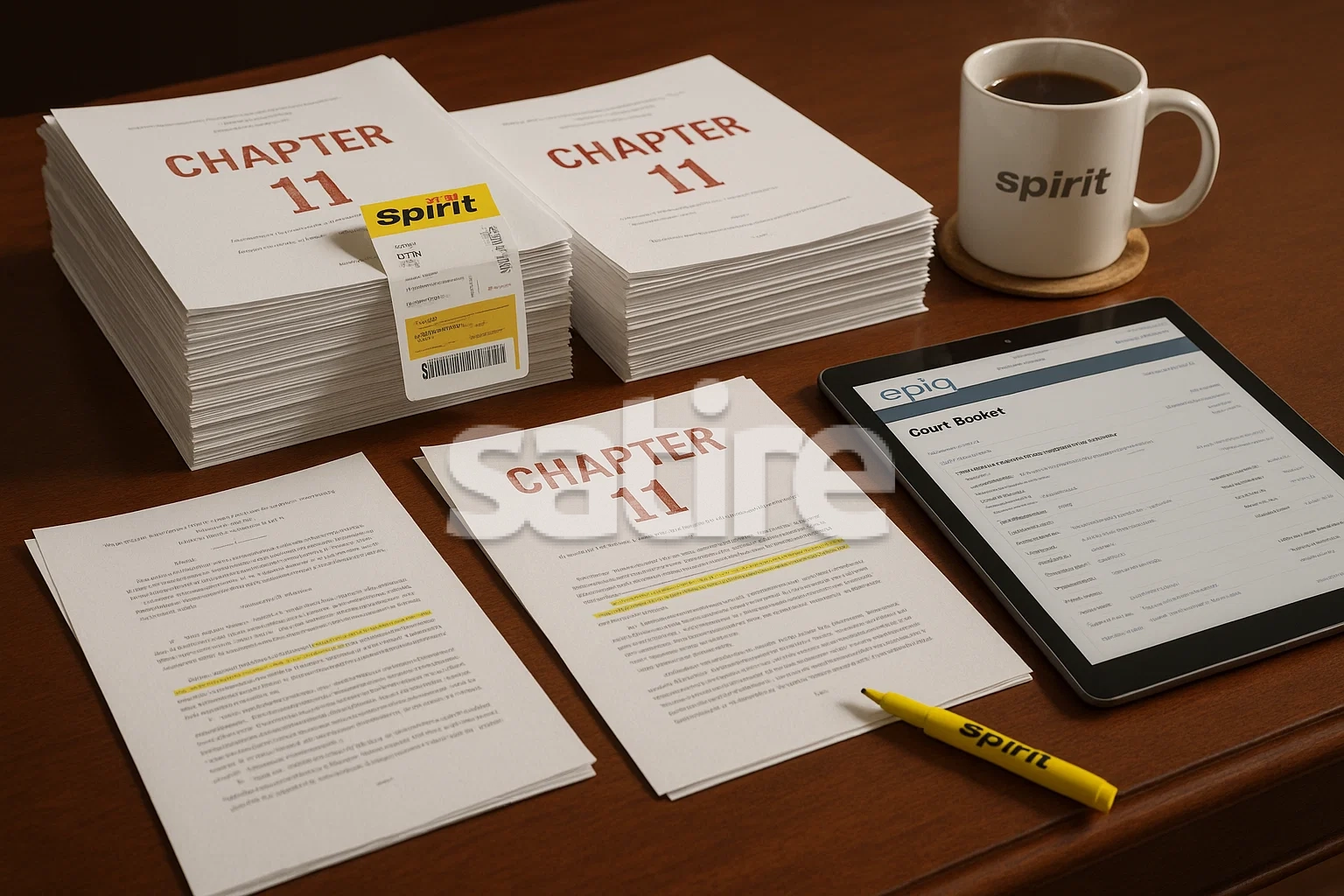

DANIA BEACH, FL — Last month we warned that four very yellow horsemen were circling the concourse, and we were not talking about gate lice. We were talking about prophecy. On August 29, that prophecy stepped off the moving walkway and right into the U.S. Bankruptcy Court for the Southern District of New York, as Spirit Airlines filed Chapter 11 again—the sequel nobody asked for and yet everyone somehow predicted.

If you missed our earlier sermon, “Budget Airline Apocalypse: Spirit’s Yellow Horsemen on Final Approach”, consider it the Book of Revelations, Gate Edition. Today’s chapter: “C-11 is now boarding.” As the court docket flickers to life and the jet bridge of due process glides into place, Spirit assures the faithful that planes will fly, points will persist, and carry-on dreams will still require a fee—see the company’s own announcement of “actions to build a stronger foundation” here.

Gate C-11 Is Now Boarding (What Filed, Where, and Who’s in Charge)

For travelers who prefer their aviation news with a boarding group, here’s the pre-departure briefing. On August 29, 2025, Spirit and affiliated debtors rolled into the Southern District of New York, drawing Case No. 25-11897 before Judge Sean H. Lane. You can watch the procedural taxi from the comfort of your device on the restructuring portal and dockets: case info and filings live at Epiq’s case page and the dockets index, while the company narrative is polished and printed at Spirit IR.

Yes, this is the second filing in less than a year, a plot twist that is less “surprise cameo” and more “we forgot to cancel the sequel.” The Reuters write-up captures the basics without charging you for legroom: a narrow-body ULCC with heavy debt and leases, plus a new plan to make the airline… smaller. Which, to be fair, is one way to hit your on-time arrival: reduce the number of places you’re going.

“First-Day Miracles”: How Operations Keep Going

Passengers want to know one thing: “Are we still flying?” According to Spirit and the court, the answer is yes. The airline announced that the judge signed off on “first-day” relief to keep the cabin pressurized—cash management, payroll, vendors, and the little matter of honoring the currency of the realm: tickets, credits, and loyalty points. ABC and other outlets echoed that continuity message, reminding travelers that their weekend plans are not, in fact, being repossessed by a bailiff in a reflective vest (ABC News).

Corporate translations are hard. “We’re still flying your itinerary” means exactly that; “normal operations” means your flight will still be delayed for normal reasons. The paperwork miracle here is not that planes fly—it’s that they do so while a team of lawyers converts a balance sheet into a flight plan. The priestly language of bankruptcy—“DIP financing,” “adequate protection,” “critical vendors”—has been painstakingly replaced with words you understand: “We will fly you. Your points still exist.” (PR Newswire companion release.)

The Glow-Down: “Shrink-to-Survive” as Strategy

The new wellness journey is not a diet; it’s a glow-down. Spirit’s court-era plan calls for a smaller fleet, fewer markets, and the gentle tapping of the brakes on expansion that looked great on a slide deck and worse on a cash flow statement. The company suggests this “shrink-to-survive” regimen aims to produce hundreds of millions in savings—a figure large enough to comfort analysts and small enough to fit into a Spirit overhead bin (IR release and PR companion).

In practical terms, this is network minimalism: do the routes that make money, or at least lose it more slowly, and renegotiate the metal you fly until lease obligations stop growling like a Pratt & Whitney on a hot day. Reuters sketches the math (expenses outpacing revenue), while the Financial Times diagrams the debt and leases that turned the balance sheet into a particularly unforgiving exit row.

Chapter 22, Explained (Why the “Prophecy” Had Teeth)

When a company files Chapter 11 twice in short succession, the internet calls it Chapter 22, not because the Bankruptcy Code says so, but because the internet insists on being helpful. Back on August 12, Spirit’s own alerts triggered the prophecy: a going-concern warning that read like the cockpit voice recorder of a business model flying through fare compression and lease headwinds. Less than three weeks later, that foreshadowing became… shadowing. The sequel opened on the same stage: SDNY, familiar judge, familiar yellow.

The FT columnists, in their elegant British way, say the quiet thing out loud: liabilities and leases can turn a ULCC from a growth story into a cautionary one. Reuters keeps the ticker moving with the “second in a year” baseline. As for “why now,” the airline ecosystem served a tasting menu of rising costs, discount wars, and the simple physics of selling seats for less than it costs to move them. The horsemen we named in August were not metaphors—they were traffic cones.

Winners’ Circle: Who Benefits While Yellow Shrinks

Nobody likes to rubberneck a restructuring, but Wall Street is that guy in 23F craning for a wing-view. The early consensus: as Spirit trims the map, some competitor pockets get lined. MarketWatch flagged an upgrade and pop for Frontier on overlap routes, while Barron’s suggested the legacy trio—United, Delta, American—could quietly pocket the spoils like seasoned travelers boarding during “families and anyone who looks rich.”

Call it the paradox of ultra-low-cost: the cheaper you fly, the more somebody else smiles when you stop. Capacity doesn’t vanish; it migrates. And the migration looks particularly profitable if your balance sheet already sleeps in lie-flat. If you want more color commentary on who stands to rise if Spirit shrinks, peel through the analyst roundups and explainers that arrived faster than a priority-tagged duffel—MarketWatch, Barron’s, and even the “what-if Spirit collapses?” hypotheticals from Investopedia.

Passenger FAQ, But Make It Revelations

Q: Is my flight operating?

A: The airline and the court both say yes; routine operations were specifically supported by the court’s first-day approvals. Even holiday-adjacent operations were addressed in public statements, with outlets framing the message as “keep calm and roll your carry-on” (ABC News).

Q: Are my miles and credits safe?

A: The airline has said it will honor tickets, travel credits, and loyalty points as it reorganizes, and courts tend to like continuity when a business intends to keep flying (company statement; ABC).

Q: What about employees and vendors?

A: “Wages, benefits, and go-forward vendor obligations” were part of the early legal housekeeping approved by the court—again, the point is to keep the machine running while the manuals are rewritten (first-day motion approval).

Appendix for the Curious: The Scrolls and the Screenshots

For readers who collect PDFs like lounge passes, the official scrolls reside with the claims agent: browse the docket index and the general case page. The corporate catechism lives at Spirit Investor Relations, with plain-English pressers on the filing and the first-day approvals. For narrative clarity with facts that don’t elbow you, Reuters is your boarding group, and for industry texture there’s the FT’s analysis.

If you like the “how did we get here?” timeline, revisit the moment the cabin lights flickered: the going-concern alert that made our August headline feel less like satire and more like weather. For market schadenfreude (it’s German for “I told you to buy Frontier”), consult MarketWatch, Barron’s, and the “who rises if yellow fades” piece at Investopedia.

Final Approach: The Prophecy Lands (and the Cabin Light Is Still On)

It turns out prophecy isn’t always fire and brimstone—sometimes it’s a well-timed SEC filing, a courthouse on Pearl Street, and a docket full of words that mean “keep the lights on.” In August, we joked about the four yellow riders; in September, they took off the costumes and clocked in as cash managers, lease negotiators, and counsel pressing “enter” on PDFs named things like First Day Wages Motion. Even the airline’s own vow to “keep flying” while it rebuilds the spreadsheet reads like liturgy at this point: rote, reassuring, and necessary (ABC; PR Newswire).

So yes… the prophecy landed, and somehow your red-eye to Fort Lauderdale still will, too. If you require comfort, see: first-day approvals and a court that prefers orderly flights to chaotic ground stops. If you require closure, see: not yet. The moral isn’t that ultra-low-cost was a fever dream; it’s that capitalism, like boarding, always happens in groups… creditors first, then employees, then vendors, then customers who remembered to tag their carry-ons.

For more revelations, parables, and occasional safety-card rewrites, taxi back to The Takeoff Nap for more.

- If you’ve ever wondered about the ominous signs leading up to Spirit Airlines’ recent turmoil, check out Budget Airline Apocalypse: Spirit’s Yellow Horsemen on Final Approach for a deeper dive into the unfolding saga.

- Wondering how your airline miles can keep their value even when airlines struggle? Dive into The Afterlife of Airline Miles: How Your Points Achieve Immortality While You Don’t to find out more.

- For an insightful look into whether big airline mergers are strategic or chaotic, explore Too Big to Land — Or Just Part of the Plan? for a deeper understanding.

- If the recent JetBlue and United deal has you feeling uncertain about your travel plans, The Truth About JetBlue And United’s Blue Sky Deal: Passengers Caught In The Turbulence offers some clarity.

- Interested in how Southwest’s policy shift on baggage fees unfolded? Don’t miss Southwest’s Farewell To Free Bags: A Military Funeral Spectacle for the full story.